Introduction

API Endpoint:

https://www.billplz.com/api/

Welcome to the Billplz API! You can use our API to access Billplz API endpoints to start sending bills and collecting payment.

Our API is organized around REST. JSON will be returned in all responses from the API, including errors. The API will accept both application/x-www-form-urlencoded and application/json.

Sandbox Mode

API Endpoint:

https://www.billplz-sandbox.com/api/

The Billplz Sandbox mirrors the features found on the real production server, while some of the features do not apply to the Sandbox.

You should test your integrations and know they will behave the same on the production server as they do in the Sandbox environment.

API Flow

In Billplz, you are interacting with Bill and Collection.

A Collection is a set of Bills. The relationship is, Collection has many Bills. You can choose to create a Collection either from API or within your Billplz's dashboard.

An example of Collection would be something like Tuition Fee for June 2015, Donation for Earthquake, Ticket Payment, and many more.

A Bill represents the promise made to you by your customer. It's an invoice for your customer. A Bill must belong to a Collection.

To start using the API, you would have to create a Collection. Then the payment flow will kick in as per below:

NORMAL COMPLETION FLOW

- Customer visits your site.

- Customer chooses to make payment.

- Your site creates a Bill via API call.

- Billplz API returns Bill's URL.

- Your site redirects the customer to Bill's URL.

- The customer makes payment via payment option of choice.

- Billplz sends a server-side update to your site upon payment failure or success. (Basic Callback URL / X Signature Callback URL depending on your configuration) [your backend server should capture the transaction update at this point] refer to X Signature Callback Url.

- Billplz redirects (Payment Completion) the customer back to your site if

redirect_urlis not empty (Basic Redirect URL / X Signature Redirect URL depending on your configuration) [your server should capture the transaction update at this point and give your user an instant reflection on the page loaded] refer to X Signature Redirect Url or, The customer will see Billplz receipt ifredirect_urlis not present.

COMPLETION FLOW WITHOUT REDIRECT_URL

- Customer visits your site.

- Customer chooses to make payment.

- Your site creates a Bill via API call.

- Billplz API returns Bill's URL.

- Your site redirects the customer to Bill's URL.

- The customer makes payment via payment option of choice.

- Billplz sends a server-side update to your site upon payment failure or success. (Basic Callback URL / X Signature Callback URL depending on your configuration)

[your backend server should capture the transaction update at this point] refer to X Signature Callback Url.

Billplz does not redirects (Payment Completion) the customer back to your site,

redirect_url(due to many possibilities, app hang, browser closed, disconnected, etc)

Authentication

To test authentication, use this code:

# With shell, you can just pass the correct HTTP Basic Auth credential with each request.

curl https://www.billplz.com/api/v4/webhook_rank \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

# Alternatively, you may use header with base64 encoded API Secret Key

curl https://www.billplz.com/api/v4/webhook_rank \

-H "Authorization: Basic NzNlYjU3ZjAtN2Q0ZS00MmI5LWE1NDQtYWVhYzZlNGIwZjgxOg=="

If authenticated, you should not see

Unauthorizedresponse type.curl uses the -u flag to pass basic auth credentials (adding a colon after your API key will prevent it from asking you for a password).

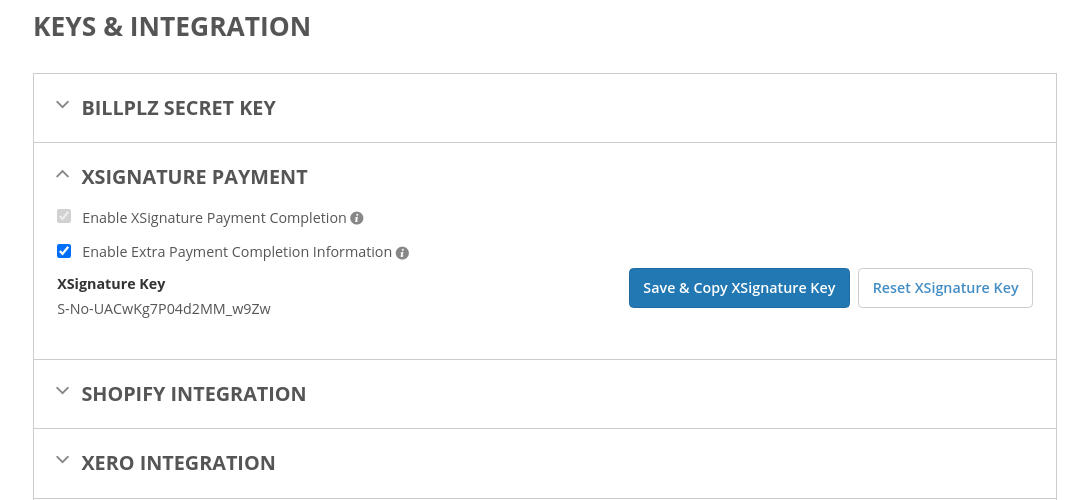

You authenticate to the Billplz API by providing your API Secret Keys in the request. You can get your API keys from your account's settings page.

Authentication to the API occurs via HTTP Basic Auth. Provide your API key as the basic auth username. You do not need to provide a password.

All API requests must be made over HTTPS. Calls made over plain HTTP will fail. You must authenticate all requests.

Integration

GitHub:

https://github.com/billplz

Knowledgebase:

https://help.billplz.com/article/53-list-of-system-with-production-ready-integration

Billplz has been integrated with many systems available in the market and always working to integrate with more platforms.

For a self-hosted system, you may download a production-ready module to integrate with your e-commerce system. Please refer to our GitHub or Knowledgebase for the list of the available module.

OAuth 2.0

Billplz provides a solution for a platform owner to connect merchants with Billplz easily. With OAuth integration, a merchant can easily integrate with Billplz by Signing In using their Billplz account. That's means; they don't have to manually copy API Secret Key, Collection ID, and X Signature Key to your platform.

Direct Payment Gateway

Bypass Billplz Bill Page

Example request:

# Creates a bill for RM 2.00 with reference_1_label and reference_1

curl https://www.billplz.com/api/v3/bills \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-d collection_id="inbmmepb" \

-d description="Maecenas eu placerat ante." \

-d email="[email protected]" \

-d name="Sara" \

-d amount="200" \

-d reference_1_label="Bank Code" \

-d reference_1="BP-FKR01" \

-d callback_url="http://example.com/webhook/"

Response:

{

"id": "8X0Iyzaw",

"collection_id": "inbmmepb",

"paid": false,

"state": "due",

"amount": 200,

"paid_amount": 0,

"due_at": "2015-3-9",

"email": "[email protected]",

"mobile": null,

"name": "SARA",

"url": "https://www.billplz.com/bills/8X0Iyzaw",

"reference_1_label": "Bank Code",

"reference_1": "BP-FKR01",

"reference_2_label": null,

"reference_2": null,

"redirect_url": null,

"callback_url": "http://example.com/webhook/",

"description": "Maecenas eu placerat ante.",

"paid_at": null

}

This Billplz Feature allows your web application to bypass the default Billplz payment option selection page, thus allowing your customers to directly proceed to the payment option preconfigured in your bill. Your customers would still fallback to the payment option selection page if the settings are invalid, or the selected payment gateway is not available.

The following guide references the Create a bill API

- Create bills through Billplz API with a with filled values for

reference_1_labelandreference_1.

- Set the value for

reference_1_labelas "Bank Code" - Set the value for

reference_1as the value of the bank code of your target payment gateway.

- Append query parameter,

auto_submit=trueto the bill's URL return from API Create a Bill.

- Example: https://www.billplz.com/bills/abcdef becomes;

- https://www.billplz.com/bills/abcdef?auto_submit=true

STANDARD PAYMENT FLOW

- Merchant creates bill through API.

- Merchant redirects payer from merchant's page to bill URL (returned from #1).

- Payer lands at Billplz page to select payment option.

- Payer redirected from Billplz to selected payment gateway to pay.

- Once payment is completed, Payer redirected from payment gateway to

redirect_url/ receipt page (refer to API Flow).

DIRECT PAYMENT GATEWAY PAYMENT FLOW

- Merchant creates bill through API with a valid bank code (note reference_1 and reference_1_label)

- Merchant redirects payer from merchant's page to bill URL (returned from #1) with extra query parameter,

?auto_submit=true - Payer skips the payment option selection page and is redirected directly to the selected payment gateway to pay

- Once payment is completed, Payer redirected from payment gateway to

redirect_url/ receipt page (refer to API Flow)

INVALID DIRECT PAYMENT GATEWAY PAYMENT FLOW

- Merchant creates bill through API with invalid / inactive bank code

- Merchant redirects payer from merchant's page to bill URL (returned from #1) with extra parameter,

?auto_submit=true - Payer will fallback to the Billplz Payment Option Selection page to select a payment gateway

- Payer redirected from Billplz to selected payment gateway to pay

- Once payment is completed, Payer redirected from payment gateway to

redirect_url/ receipt page (refer to API Flow)

V3

This version is not in active development state. No new feature will be introduced in this version.

Collections

Collections are where all of your Bills are belongs to. Collections can be useful to categorize your bill payment. As an example, you may use Collection to separate a Tuition Fee Collection for September and November collection.

Create a Collection

Billplz API now supports the creation of collection with a split rule feature. The response will contain the collection's ID that is needed in Bill API, split rule info and fields.

Example request:

# Creates a collection

curl https://www.billplz.com/api/v3/collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-F title="My First API Collection"

Response:

{

"id": "inbmmepb",

"title": "My First API Collection",

"logo": {

"thumb_url": null,

"avatar_url": null

},

"split_payment": {

"email": null,

"fixed_cut": null,

"variable_cut": null,

"split_header": false

}

}

Example request with optional arguments:

curl https://www.billplz.com/api/v3/collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-F title="My First API Collection" \

-F logo=@/Users/Billplz/Documents/uploadPhoto.png \

-F split_payment[email]="[email protected]" \

-F split_payment[fixed_cut]=100 \

-F split_payment[split_header]=true

Response:

{

"id": "inbmmepb",

"title": "My First API Collection",

"logo": {

"thumb_url": "https://sample.net/assets/uploadPhoto.png",

"avatar_url": "https://sample.net/assets/uploadPhoto.png"

},

"split_payment": {

"email": "[email protected]",

"fixed_cut": 100,

"variable_cut": null,

"split_header": true

}

}

HTTP Request

POST https://www.billplz.com/api/v3/collections

REQUIRED ARGUMENTS

| Parameter | Description |

|---|---|

| title | The collection title. Will be displayed on bill template. String format. |

OPTIONAL ARGUMENTS

| Parameter | Description |

|---|---|

| logo | This image will be resized to avatar (40x40) and thumb (180x180) dimensions. Whitelisted formats are jpg, jpeg, gif and png. |

| split_payment[email] | The email address of the split rule's recipient. (The account must be a verified account.) |

| split_payment[fixed_cut] | A positive integer in the smallest currency unit that is going in your account (e.g 100 cents to charge RM 1.00) This field is required if split_payment[variable_cut] is not present. |

| split_payment[variable_cut] | Percentage in positive integer format that is going in your account. This field is required if split_payment[fixed_cut] is not present. |

| split_payment[split_header] | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | ID that represents a collection. |

| title | The collection's title in string format. |

| logo[thumb_url] | The thumb dimension's (180x180) URL. |

| logo[avatar_url] | The avatar dimension's (40x40) URL. |

| split_payment[email] | The 1st recipient's email. It only returns the 1st recipient eventhough there is multiple recipients being set. If you wish to have 2 recipients, please refer to V4 Create a Collection. |

| split_payment[fixed_cut] | The 1st recipient's fixed cut in smallest and positive currency unit. |

| split_payment[variable_cut] | The 1st recipient's percentage cut in positive integer format. |

| split_payment[split_header] | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

Get a Collection

Use this API to query your collection record.

Example request:

# Get a collection

curl https://www.billplz.com/api/v3/collections/inbmmepb \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"id": "inbmmepb",

"title": "My First API Collection",

"logo": {

"thumb_url": null,

"avatar_url": null

},

"split_payment": {

"email": null,

"fixed_cut": null,

"variable_cut": null,

"split_header": false

},

"status": "active"

}

HTTP REQUEST

GET https://www.billplz.com/api/v3/collections/{COLLECTION_ID}

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | Collection ID returned in Collection object. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | ID that represents a collection. |

| title | The collection's title in string format. |

| logo[thumb_url] | The thumb dimension's (180x180) URL. |

| logo[avatar_url] | The avatar dimension's (40x40) URL. |

| split_payment[email] | The 1st recipient's email. It only returns the 1st recipient eventhough there is multiple recipients being set. If you wish to have 2 recipients, please refer to V4 Create a Collection. |

| split_payment[fixed_cut] | The 1st recipient's fixed cut in smallest and positive currency unit. |

| split_payment[variable_cut] | The 1st recipient's percentage cut in positive integer format. |

| split_payment[split_header] | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

| status | Collection's status, it is either active and inactive. |

Get Collection Index

Use this API to retrieve your collections list. To utilise paging, append a page parameter to the URL e.g. ?page=1. If there are 15 records in the response, you will need to check if there is any more data by fetching the next page, e.g. ?page=2 and continuing this process until no more results are returned.

Example request:

# Get collection index

curl https://www.billplz.com/api/v3/collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"collections": [

{

"id": "inbmmepb",

"title": "My First API Collection",

"logo": {

"thumb_url": null,

"avatar_url": null

},

"split_payment": {

"email": null,

"fixed_cut": null,

"variable_cut": null,

"split_header": false

},

"status": "active"

}

],

"page": 1

}

Example request with optional arguments:

# Get collection index

curl https://www.billplz.com/api/v3/collections?page=2&status=active \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"collections": [

{

"id": "inbmmepb",

"title": "My First API Collection",

"logo": {

"thumb_url": null,

"avatar_url": null

},

"split_payment": {

"email": null,

"fixed_cut": null,

"variable_cut": null,

"split_header": false

},

"status": "active"

}

],

"page": 2

}

HTTP REQUEST

GET https://www.billplz.com/api/v3/collections

OPTIONAL ARGUMENTS

| Parameter | Description |

|---|---|

| page | Up to 15 collections will be returned in a single API call per specified page. Default to 1 if not present. |

| status | Parameter to filter collection's status, valid value are active and inactive. |

Create an Open Collection

Billplz API now supports the creation of open collections (Payment Form) with a split rule feature. The response contains the collection's attributes, including the payment form URL.

Example request:

# Creates an open collection

curl https://www.billplz.com/api/v3/open_collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-d title="My First API Open Collection" \

-d description="Maecenas eu placerat ante." \

-d amount=299

Response:

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante.",

"reference_1_label": null,

"reference_2_label": null,

"email_link": null,

"amount": 299,

"fixed_amount": true,

"tax": null,

"fixed_quantity": true,

"payment_button": "pay",

"photo": {

"retina_url": null,

"avatar_url": null

},

"split_payment": {

"email": null,

"fixed_cut": null,

"variable_cut": null,

"split_header": false

},

"url": "https://www.billplz.com/0pp87t_6"

}

Example request with optional arguments:

# Creates a collection

curl https://www.billplz.com/api/v3/open_collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-F title="My First API Open Collection" \

-F description="Maecenas eu placerat ante." \

-F fixed_amount=false \

-F fixed_quantity=false \

-F payment_button="buy" \

-F reference_1_label="ID No" \

-F reference_2_label="First Name" \

-F email_link="http://www.test.com" \

-F tax=1 \

-F photo=@/Users/Billplz/Documents/uploadPhoto.png \

-F split_payment[email]="[email protected]" \

-F split_payment[variable_cut]=20 \

-F split_payment[split_header]=true

Response:

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante.",

"reference_1_label": "ID No",

"reference_2_label": "First Name",

"email_link": "http://www.test.com",

"amount": null,

"fixed_amount": false,

"tax": 1,

"fixed_quantity": false,

"payment_button": "buy",

"photo": {

"retina_url": "https://sample.net/assets/uploadPhoto.png",

"avatar_url": "https://sample.net/assets/uploadPhoto.png"

},

"split_payment": {

"email": "[email protected]",

"fixed_cut": null,

"variable_cut": 20,

"split_header": true

},

"url": "https://www.billplz.com/0pp87t_6"

}

HTTP REQUEST

POST https://www.billplz.com/api/v3/open_collections

REQUIRED ARGUMENTS

| Parameter | Description |

|---|---|

| title | The collection title. It's showing up on the payment form. String format. (Max of 50 characters) |

| description | The collection description. Will be displayed on payment form. String format. (Max of 200 characters) |

| amount | A positive integer in the smallest currency unit (e.g 100 cents to charge RM 1.00) Required if fixed_amount is true; Ignored if fixed_amount is false |

OPTIONAL ARGUMENTS

| Parameter | Description |

|---|---|

| fixed_amount | Boolean value. Set this to false for Open Amount. Default value is true |

| fixed_quantity | Boolean value. Set this to false for Open Quantity. Default value is true |

| payment_button | Payment button's text. Available options are buy and pay. Default value is pay |

| reference_1_label | Label #1 to reconcile payments (Max of 20 characters). Default value is Reference 1. |

| reference_2_label | Label #2 to reconcile payments. (Max of 20 characters). Default value is Reference 2. |

| email_link | A URL that email to customer after payment is successful. |

| tax | Tax rate in positive integer format. |

| photo | This image will be resized to retina (Yx960) and avatar (180x180) dimensions. Whitelisted formats are jpg, jpeg, gif and png. |

| split_payment[email] | The email address of the split rule's recipient. (The account must be a verified account.) |

| split_payment[fixed_cut] | A positive integer in the smallest currency unit that is going in your account (e.g 100 cents to charge RM 1.00). This field is required if split_payment[variable_cut] is not present |

| split_payment[variable_cut] | Percentage in positive integer format that is going in your account. This field is required if split_payment[fixed_cut] is not present |

| split_payment[split_header] | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | The collection ID. |

| title | The collection's title. |

| description | The collection description. |

| reference_1_label | Label #1 to reconcile payments. |

| reference_2_label | Label #2 to reconcile payments. |

| email_link | A URL that email to customer after payment is successful. |

| amount | The collection's fixed amount to create bill in the smallest currency unit (cents). |

| fixed_amount | Boolean value. It returns to false if Open Amount. |

| tax | Tax rate in positive integer format. |

| fixed_quantity | Boolean value. It returns false if Open Quantity. |

| payment_button | Payment button's text. |

| photo[retina_url] | The retina dimension's (960x960) URL. |

| photo[avatar_url] | The avatar dimension's (180x180) URL. |

| split_payment[email] | The 1st recipient's email. It only returns the 1st recipient eventhough there is multiple recipients being set. If you wish to have 2 recipients, please refer to API#v4-create-an-open-collection. |

| split_payment[fixed_cut] | The 1st recipient's fixed cut in smallest and positive currency unit (cents). |

| split_payment[variable_cut] | The 1st recipient's percentage cut in positive integer format. |

| split_payment[split_header] | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

| url | URL to the collection. |

Get an Open Collection

Use this API to query your open collection record.

Example request:

# Get an open collection

curl https://www.billplz.com/api/v3/open_collections/0pp87t_6 \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante.",

"reference_1_label": null,

"reference_2_label": null,

"email_link": null,

"amount": 299,

"fixed_amount": true,

"tax": null,

"fixed_quantity": true,

"payment_button": "pay",

"photo": {

"retina_url": null,

"avatar_url": null

},

"split_payment": {

"email": null,

"fixed_cut": null,

"variable_cut": null,

"split_header": false

},

"url": "https://www.billplz.com/0pp87t_6",

"status": "active"

}

HTTP REQUEST

GET https://www.billplz.com/api/v3/open_collections/{COLLECTION_ID}

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | Collection ID returned in Collection object. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | The collection ID. |

| title | The collection's title. |

| description | The collection description. |

| reference_1_label | Label #1 to reconcile payments. |

| reference_2_label | Label #2 to reconcile payments. |

| email_link | A URL that email to customer after payment is successful. |

| amount | The collection's fixed amount to create bill in the smallest currency unit (cents). |

| fixed_amount | Boolean value. It returns to false if Open Amount. |

| tax | Tax rate in positive integer format. |

| fixed_quantity | Boolean value. It returns false if Open Quantity. |

| payment_button | Payment button's text. |

| photo[retina_url] | The retina dimension's (960x960) URL. |

| photo[avatar_url] | The avatar dimension's (180x180) URL. |

| split_payment[email] | The 1st recipient's email. It only returns the 1st recipient eventhough there is multiple recipients being set. If you wish to have 2 recipients, please refer to API#v4-create-an-open-collection. |

| split_payment[fixed_cut] | The 1st recipient's fixed cut in smallest and positive currency unit. |

| split_payment[variable_cut] | The 1st recipient's percentage cut in positive integer format. |

| split_payment[split_header] | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

| url | URL to the collection. |

| status | Collection's status, it is either active or inactive. |

Get an Open Collection Index

Use this API to retrieve your open collections list. To utilise paging, append a page parameter to the URL e.g. ?page=1. If there are 15 records in the response you will need to check if there is any more data by fetching the next page e.g. ?page=2 and continuing this process until no more results are returned.

Example request:

# Get an open collection index

curl https://www.billplz.com/api/v3/open_collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"open_collections": [

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante.",

"reference_1_label": "ID No",

"reference_2_label": "First Name",

"email_link": "http://www.test.com",

"amount": null,

"fixed_amount": false,

"tax": 1,

"fixed_quantity": false,

"payment_button": "buy",

"photo": {

"retina_url": "https://sample.net/assets/uploadPhoto.png",

"avatar_url": "https://sample.net/assets/uploadPhoto.png"

},

"split_payment": {

"email": "[email protected]",

"fixed_cut": null,

"variable_cut": 20,

"split_header": false

},

"url": "https://www.billplz.com/0pp87t_6",

"status": "active"

}

],

"page": 1

}

Example request with optional arguments:

# Get an open collection index

curl https://www.billplz.com/api/v3/open_collections?page=2&status=active \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"open_collections": [

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante. Fusce ut neque justo, et aliquet enim. In hac habitasse platea dictumst.",

"reference_1_label": "ID No",

"reference_2_label": "First Name",

"email_link": "http://www.test.com",

"amount": null,

"fixed_amount": false,

"tax": 1,

"fixed_quantity": false,

"payment_button": "buy",

"photo": {

"retina_url": "https://sample.net/assets/uploadPhoto.png",

"avatar_url": "https://sample.net/assets/uploadPhoto.png"

},

"split_payment": {

"email": "[email protected]",

"fixed_cut": null,

"variable_cut": 20,

"split_header": false

},

"url": "https://www.billplz.com/0pp87t_6",

"status": "active"

}

],

"page": 2

}

HTTP REQUEST

GET https://www.billplz.com/api/v3/open_collections

OPTIONAL ARGUMENTS

| Parameter | Description |

|---|---|

| page | Up to 15 open collections will be returned in a single API call per specified page. Default to 1 if not present. |

| status | Parameter to filter open collection's status, valid value are active and inactive. |

Deactivate a Collection

Both Collection and Open Collection can be deactivated via this API. The API will respond with error messages if the collection cannot be deactivated.

Example request:

# Deactivate a collection or open collection

curl -X POST \

https://www.billplz.com/api/v3/collections/qag4fe_o6/deactivate \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{}

HTTP REQUEST

https://www.billplz.com/api/v3/collections/{COLLECTION_ID}/deactivate

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | Collection ID returned in Collection object. |

Activate a Collection

Both Collection and Open Collection can be activated via this API. The API will respond with error messages if the collection cannot be activated.

Example request:

# Activate a collection or open collection

curl -X POST \

https://www.billplz.com/api/v3/collections/qag4fe_o6/activate \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{}

HTTP REQUEST

https://www.billplz.com/api/v3/collections/{COLLECTION_ID}/activate

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | Collection ID returned in Collection object. |

Bills

Bills need to be created inside a collection. It must be either Collection or Open Collection. However, only Collection can be used to create a bill via API and Open Collection cannot be used to create a bill via API.

Create a Bill

To create a bill, you would need the collection's ID. Each bill must be created within a collection. To get your collection ID, visit the collection page on your Billplz account.

The bill's collection will be set to active automatically.

Example request:

# Creates a bill for RM 2.00

curl https://www.billplz.com/api/v3/bills \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-d collection_id=inbmmepb \

-d description="Maecenas eu placerat ante." \

-d email=[email protected] \

-d name="Sara" \

-d amount=200 \

-d callback_url="http://example.com/webhook/"

Response:

{

"id": "8X0Iyzaw",

"collection_id": "inbmmepb",

"paid": false,

"state": "due",

"amount": 200,

"paid_amount": 0,

"due_at": "2015-3-9",

"email": "[email protected]",

"mobile": null,

"name": "Sara",

"url": "https://www.billplz.com/bills/8X0Iyzaw",

"reference_1_label": "Reference 1",

"reference_1": null,

"reference_2_label": "Reference 2",

"reference_2": null,

"redirect_url": null,

"callback_url": "http://example.com/webhook/",

"description": "Maecenas eu placerat ante."

}

Example request with optional arguments:

# Creates a bill for RM 2.00

curl https://www.billplz.com/api/v3/bills \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-d collection_id=inbmmepb \

-d email=[email protected] \

-d name="Sara" \

-d amount=200 \

-d callback_url="http://example.com/webhook/" \

-d description="Maecenas eu placerat ante." \

-d due_at="2020-12-31" \

-d mobile="+60112223333" \

-d reference_1_label="First Name" \

-d reference_2_label="Last Name" \

-d reference_1="Sara" \

-d reference_2="Dila" \

-d deliver=false \

-d redirect_url="http://example.com/redirect/"

Response:

{

"id": "8X0Iyzaw",

"collection_id": "inbmmepb",

"paid": false,

"state": "due",

"amount": 200,

"paid_amount": 0,

"due_at": "2020-12-31",

"email": "[email protected]",

"mobile": "+60112223333",

"name": "Sara",

"url": "https://www.billplz.com/bills/8X0Iyzaw",

"reference_1_label": "First Name",

"reference_1": "Sara",

"reference_2_label": "Last Name",

"reference_2": "Dila",

"redirect_url": "http://example.com/redirect/",

"callback_url": "http://example.com/webhook/",

"description": "Maecenas eu placerat ante."

}

HTTP REQUEST

POST https://www.billplz.com/api/v3/bills

REQUIRED ARGUMENTS

| Parameter | Description |

|---|---|

| collection_id | The collection ID. A string. |

| The email address of the bill's recipient (Email is required if mobile is not present). | |

| mobile | Recipient's mobile number. Be sure that all mobile numbers include country code, area code and number without spaces or dashes. (e.g., +60122345678 or 60122345678). Use Google libphonenumber library to help. Mobile is required if email is not present. |

| name | Bill's recipient name. Useful for identification on recipient part. (Max of 255 characters). |

| amount | A positive integer in the smallest currency unit (e.g 100 cents to charge RM 1.00). |

| callback_url | Web hook URL to be called after payment's transaction completed. It will POST a Bill object. |

| description | The bill's description. Will be displayed on bill template. String format (Max of 200 characters). |

OPTIONAL ARGUMENTS

| Parameter | Description |

|---|---|

| due_at | Due date for the bill. The format YYYY-MM-DD, default value is today. Year range is 19xx to 2xxx. Please note that due_at value does not affect the bill's payability and is only for informational reference. |

| redirect_url | URL to redirect the customer after payment completed. It will do a GET to redirect_url together with bill's status and ID. |

| deliver | Boolean value to set email and SMS (if mobile is present) delivery. Default value is false. SMS is subjected to charges depending on subscribed plan. |

| reference_1_label | Label #1 to reconcile payments (Max of 20 characters). Default value is Reference 1. |

| reference_1 | Value for reference_1_label (Max of 120 characters). |

| reference_2_label | Label #2 to reconcile payments (Max of 20 characters). Default value is Reference 2. |

| reference_2 | Value for reference_2_label (Max of 120 characters). |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | Bill ID that represents a bill. |

| url | URL to the bill. |

Get a Bill

At any given time, you can request a bill to check on the status. It will return the bill object.

Example request:

# Get a bill

curl https://www.billplz.com/api/v3/bills/8X0Iyzaw \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"id": "8X0Iyzaw",

"collection_id": "inbmmepb",

"paid": false,

"state": "due",

"amount": 200,

"paid_amount": 0,

"due_at": "2020-12-31",

"email": "[email protected]",

"mobile": "+60112223333",

"name": "SARA",

"url": "https://www.billplz.com/bills/8X0Iyzaw",

"reference_1_label": "First Name",

"reference_1": "Sara",

"reference_2_label": "Last Name",

"reference_2": "Dila",

"redirect_url": "http://example.com/redirect/",

"callback_url": "http://example.com/webhook/",

"description": "Maecenas eu placerat ante."

}

HTTP REQUEST

GET https://www.billplz.com/api/v3/bills/{BILL_ID}

URL PARAMETER

| Parameter | Description |

|---|---|

| BILL_ID | Bill ID returned in Bill object. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| paid | Boolean value to tell if a bill has paid. It will return false for due bills; true for paid bills. |

| state | State that representing the bill's status, possible states are due, paid and deleted. |

Delete a Bill

Only due bill can be deleted. Paid bill can't be deleted. Deleting a bill is useful in a scenario where there's a time limitation to payment.

Example usage would be to show a timer for customer to complete payment within 10 minutes with a grace period of 5 minutes. After 15 minutes of bill creation, get bill status and delete if bill is still due.

Example Request:

# Delete a Bill

curl -X DELETE https://www.billplz.com/api/v3/bills/8X0Iyzaw \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{}

HTTP REQUEST

DELETE https://www.billplz.com/api/v3/bills/{BILL_ID}

URL PARAMETER

| Parameter | Description |

|---|---|

| BILL_ID | Bill ID returned in Bill object. |

Transactions

Get Transaction Index

Use this API to retrieve your bill's transactions. To utilise paging, append a page parameter to the URL e.g. ?page=1. If there are 15 records in the response you will need to check if there is any more data by fetching the next page e.g. ?page=2 and continuing this process until no more results are returned.

Example Request:

# Get transaction index

curl https://www.billplz.com/api/v3/bills/inbmmepb/transactions \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"bill_id": "inbmmepb",

"transactions": [

{

"id": "60793D4707CD",

"status": "completed",

"completed_at": "2017-02-23T12:49:23.612+08:00",

"payment_channel": "FPX"

},

{

"id": "28F3D3194138",

"status": "failed",

"completed_at": null,

"payment_channel": "FPX"

}

],

"page": 1

}

Example request with optional arguments:

curl https://www.billplz.com/api/v3/bills/inbmmepb/transactions?page=1&status=completed \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"bill_id": "inbmmepb",

"transactions": [

{

"id": "60793D4707CD",

"status": "completed",

"completed_at": "2017-02-23T12:49:23.612+08:00",

"payment_channel": "FPX"

}

],

"page": 1

}

HTTP REQUEST

GET https://www.billplz.com/api/v3/bills/{BILL_ID}/transactions

URL PARAMETER

| Parameter | Description |

|---|---|

| page | Up to 15 transactions will be returned in a single API call per specified page. Default to 1 if not present. |

| status | Parameter to filter transaction's status. Valid values are pending, completed and failed. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| bill_id | ID that represent the bill. |

| id | ID that represent the transaction. |

| status | Status that representing the transaction's status, possible statuses are pending, completed and failed. |

| completed_at | Datetime format when the transaction is completed. ISO 8601 format is used. |

| payment_channel | Payment channel that the transaction is made. Possible values are AMEXMBB, BANKISLAM, BILLPLZ, BOOST, TOUCHNGO, EBPGMBB, FPX, FPXB2B1, ISUPAYPAL, MPGS, OCBC, PAYDEE, RAZERPAYWALLET, SECUREACCEPTANCE, SENANGPAY, TWOCTWOP, TWOCTWOPIPP, and TWOCTWOPWALLET. |

Payment Methods

Get Payment Method Index

The get payment methods index API allows to retrieve all available payment methods that you can enable / disable to a collection.

Example Request:

# Get payment method index

curl https://www.billplz.com/api/v3/collections/0idsxnh5/payment_methods \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"payment_methods": [

{

"code": "paypal",

"name": "PAYPAL",

"active": true

},

{

"code": "fpx",

"name": "Online Banking",

"active": false

}

]

}

HTTP REQUEST

GET https://www.billplz.com/api/v3/collections/{COLLECTION_ID}/payment_methods

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | ID that represents the collection where the payment methods belong to. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| code | Unique payment method's specific code, in string value. |

| name | Payment method's general name, in string value. |

| active | The API will return payment method's status for a collection, in boolean value. It returns true if this payment method has enabled for the collection. |

Update Payment Methods

Pass the payment method's code to the API to update your collection's payment methods.

Invalid payment method code will be ignored.

Example Request:

# Update payment methods

curl -X PUT -d payment_methods[][code]='fpx' -d payment_methods[][code]='paypal' https://www.billplz.com/api/v3/collections/0idsxnh5/payment_methods \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"payment_methods": [

{

"code": "paypal",

"name": "PAYPAL",

"active": true

},

{

"code": "fpx",

"name": "Online Banking",

"active": true

}

]

}

HTTP REQUEST

PUT https://www.billplz.com/api/v3/collections/{COLLECTION_ID}/payment_methods

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | ID that represents the collection where the payment methods belong to. |

| payment_methods | Array that contains all codes in hash format. code in hash represents the unique payment method's code that you would like to enable. Do not pass the code if you would like to disable a payment method. Ex, "payment_methods"=>[{"code"=>"fpx"}] would enable fpx (Online Banking) and disable paypal (PAYPAL). Possible values are amexmbb, bankislam, billplz, boost, touchngo, ebpgmbb, fpx, fpxb2b1, isupaypal, mpgs, ocbc, paydee, razerpaywallet, secureacceptance, senangpay, twoctwop, twoctwopipp, and twoctwopwallet. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| code | Unique payment method's specific code, in string value. |

| name | Payment method's general name, in string value. |

| active | Payment method current's status for the collection, in boolean value. It is true if this payment method has enabled for the collection. |

Get FPX Banks

Use this API to get a list of bank codes that need for setting reference_1 in API#bypass-billplz-bill-page.

This API only return list of bank codes for online banking, if you looking for a complete payment gateways' bank code, please use API#get-payment-gateways instead.

Example Request:

# Get FPX Banks

curl https://www.billplz.com/api/v3/fpx_banks \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"banks": [

{

"name": "MBU0227",

"active": true

},

{

"name": "OCBC0229",

"active": false

},

{

"name": "MB2U0227",

"active": true

}

]

}

HTTP REQUEST

GET https://www.billplz.com/api/v3/fpx_banks

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| name | This is the bank code that need to set to reference_1. Case sensitive. |

| active | true or false boolean that represents bank's availability. If an inactive bank was set to reference_1, the payment process will show Billplz page for payer to choose another bank from the list. |

Fpx Bank Abbreviations

| Bank Code | Bank Name |

|---|---|

| ABMB0212 | allianceonline |

| ABB0233 | affinOnline |

| ABB0234* | Affin Bank |

| AMBB0209 | AmOnline |

| BCBB0235 | CIMB Clicks |

| BIMB0340 | Bank Islam Internet Banking |

| BKRM0602 | i-Rakyat |

| BMMB0341 | i-Muamalat |

| BOCM01* | Bank of China |

| BSN0601 | myBSN |

| CIT0219 | Citibank Online |

| HLB0224 | HLB Connect |

| HSBC0223 | HSBC Online Banking |

| KFH0346 | KFH Online |

| MB2U0227 | Maybank2u |

| MBB0228 | Maybank2E |

| OCBC0229 | OCBC Online Banking |

| PBB0233 | PBe |

| RHB0218 | RHB Now |

| SCB0216 | SC Online Banking |

| UOB0226 | UOB Internet Banking |

| UOB0229* | UOB Bank |

| TEST0001* | Test 0001 |

| TEST0002* | Test 0002 |

| TEST0003* | Test 0003 |

| TEST0004* | Test 0004 |

| TEST0021* | Test 0021 |

| TEST0022* | Test 0022 |

| TEST0023* | Test 0023 |

* Only applicable in staging environment.

V4

This version is in active development state. New feature will be introduced in this version.

Collections

Collections are where all of your Bills are belongs to. Collections can be useful to categorize your bill payment. As an example, you may use Collection to separate a Tuition Fee Collection for September and November collection.

Create a Collection

Billplz API now support creation of collection with 2 split rules feature, the response will contain the collection's ID that is needed in Bill API, split rules info and fields

Example Request:

# Creates a collection

curl https://www.billplz.com/api/v4/collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-F title="My First V4 API Collection"

Response:

{

"id": "inbmmepb",

"title": "My First V4 API Collection",

"logo": {

"thumb_url": null,

"avatar_url": null

},

"split_header": false,

"split_payments": []

}

Example request with optional arguments:

curl https://www.billplz.com/api/v4/collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-F title="My First V4 API Collection"\

-F split_payments[][email]="[email protected]" \

-F split_payments[][fixed_cut]=100 \

-F split_payments[][variable_cut]=2\

-F split_payments[][stack_order]=0\

-F split_payments[][email]="[email protected]" \

-F split_payments[][fixed_cut]=200 \

-F split_payments[][variable_cut]=3\

-F split_payments[][stack_order]=1

Response:

{

"id": "inbmmepb",

"title": "My First V4 API Collection",

"logo": {

"thumb_url": null,

"avatar_url": null

},

"split_header": false,

"split_payments": [

{

"email": "[email protected]",

"fixed_cut": 100,

"variable_cut": 2,

"stack_order": 0

},

{

"email": "[email protected]",

"fixed_cut": 200,

"variable_cut": 3,

"stack_order": 1

}

]

}

HTTP REQUEST

POST https://www.billplz.com/api/v4/collections

REQUIRED ARGUMENTS

| Parameter | Description |

|---|---|

| title | The collection title. Will be displayed on bill template. String format. |

OPTIONAL ARGUMENTS

| Parameter | Description |

|---|---|

| split_payments[][email] | The email address of the split rule's recipient (The account must be a verified account). |

| split_payments[][fixed_cut] | A positive integer in the smallest currency unit that is going in your account (e.g 100 cents to charge RM 1.00). This field is required if split_payment[variable_cut] is not present. |

| split_payments[][variable_cut] | Percentage in positive integer format that is going in your account. This field is required if split_payment[fixed_cut] is not present. |

| split_payments[][stack_order] | Integer format that defines the sequence of the split rule recipients. This field is required and must be in correct order starts from 0 and increment by 1 subsequently if you want to set a split rule. This input is crucial to determine a precise recipient's order. |

| split_header | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | ID that represents a collection. |

| title | The collection's title in string format. |

| logo[thumb_url] | The thumb dimension's (180x180) URL. |

| logo[avatar_url] | The avatar dimension's (40x40) URL. |

| split_header | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

| split_payments | Array that contains all split rule recipients in hash format. |

| in hash represents the recipient's email. | |

| fixed_cut | in hash represents the recipient's fixed cut in smallest and positive currency unit. |

| variable_cut | The recipient's percentage cut in positive integer format. |

| stack_order | The order of the recipient defined in split rules. |

Get a Collection

Use this API to query your collection record.

Example request:

# Get a collection

curl https://www.billplz.com/api/v4/collections/inbmmepb \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"id": "inbmmepb",

"title": "My First API Collection",

"logo": {

"thumb_url": null,

"avatar_url": null

},

"split_header": false,

"split_payments": [

{

"email": "[email protected]",

"fixed_cut": 100,

"variable_cut": 2,

"stack_order": 0

},

{

"email": "[email protected]",

"fixed_cut": 200,

"variable_cut": 3,

"stack_order": 1

}

],

"status": "active"

}

HTTP REQUEST

GET https://www.billplz.com/api/v4/collections/{COLLECTION_ID}

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | ID that represents a collection. |

| title | The collection's title in string format. |

| logo[thumb_url] | The thumb dimension's (180x180) URL. |

| logo[avatar_url] | The avatar dimension's (40x40) URL. |

| split_header | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

| split_payments | Array that contains all split rule recipients in hash format. email in hash represents the recipient's email. fixed_cut in hash represents the recipient's fixed cut in smallest and positive currency unit. variable_cut is the recipient's percentage cut in positive integer format.stack_order is the order of the recipient defined in split rules. |

| status | Collection's status, it is either active and inactive. |

Get Collection Index

Use this API to retrieve your collections list. To utilise paging, append a page parameter to the URL e.g. ?page=1. If there are 15 records in the response you will need to check if there is any more data by fetching the next page e.g. ?page=2 and continuing this process until no more results are returned.

Example request:

# Get collection index

curl https://www.billplz.com/api/v4/collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"collections": [

{

"id": "inbmmepb",

"title": "My First API Collection",

"logo": {

"thumb_url": null,

"avatar_url": null

},

"split_header": false,

"split_payments": [],

"status": "active"

}

],

"page": 1

}

Example request with optional arguments:

# Get collection index

curl https://www.billplz.com/api/v4/collections?page=2&status=active \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"collections": [

{

"id": "inbmmepb",

"title": "My First API Collection",

"logo": {

"thumb_url": null,

"avatar_url": null

},

"split_header": false,

"split_payments": [],

"status": "active"

}

],

"page": 2

}

HTTP REQUEST

GET https://www.billplz.com/api/v4/collections

OPTIONAL ARGUMENTS

| Parameter | Description |

|---|---|

| page | Up to 15 collections will be returned in a single API call per specified page. Default to 1 if not present. |

| status | Parameter to filter collection's status, valid value are active and inactive. |

Create an Open Collection

Billplz API now support creation of open collections (Payment Form) with 2 split rule recipients feature, the response will contain the collection's attributes, including the payment form URL.

Example request:

# Creates an open collection

curl https://www.billplz.com/api/v4/open_collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-d title="My First API Open Collection" \

-d description="Maecenas eu placerat ante." \

-d amount=299

Response:

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante.",

"reference_1_label": null,

"reference_2_label": null,

"email_link": null,

"amount": 299,

"fixed_amount": true,

"tax": null,

"fixed_quantity": true,

"payment_button": "pay",

"photo": {

"retina_url": null,

"avatar_url": null

},

"split_header": false,

"split_payments": [],

"url": "https://www.billplz.com/0pp87t_6",

"redirect_uri": null

}

Example request with optional arguments:

# Creates a collection

curl https://www.billplz.com/api/v4/open_collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-F title="My First API Open Collection" \

-F description="Maecenas eu placerat ante." \

-F fixed_amount=false \

-F fixed_quantity=false \

-F payment_button="buy" \

-F reference_1_label="ID No" \

-F reference_2_label="First Name" \

-F email_link="http://www.test.com" \

-F tax=1 \

-F photo=@/Users/Billplz/Documents/uploadPhoto.png \

-F split_header=true \

-F split_payments[][email]="[email protected]" \

-F split_payments[][variable_cut]=20 \

-F split_payments[][stack_order]=0 \

-F redirect_uri="http://www.test.com"

Response:

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante.",

"reference_1_label": "ID No",

"reference_2_label": "First Name",

"email_link": "http://www.test.com",

"amount": null,

"fixed_amount": false,

"tax": 1,

"fixed_quantity": false,

"payment_button": "buy",

"photo": {

"retina_url": "https://sample.net/assets/uploadPhoto.png",

"avatar_url": "https://sample.net/assets/uploadPhoto.png"

},

"split_header": true,

"split_payments": [

{

"email": "[email protected]",

"fixed_cut": null,

"variable_cut": 20,

"stack_order": 0

}

],

"url": "https://www.billplz.com/0pp87t_6",

"redirect_uri": "http://www.test.com"

}

HTTP REQUEST

POST https://www.billplz.com/api/v4/open_collections

REQUIRED ARGUMENTS

| Parameter | Description |

|---|---|

| title | The collection title. Will be displayed on payment form. String format (Max of 50 characters). |

| description | The collection description. Will be displayed on payment form. String format (Max of 200 characters). |

| amount | A positive integer in the smallest currency unit (e.g 100 cents to charge RM 1.00). Required if fixed_amount is true; Ignored if fixed_amount is false. |

OPTIONAL ARGUMENTS

| Parameter | Description |

|---|---|

| fixed_amount | Boolean value. Set fixed_amount to false for Open Amount. Default value is true. |

| fixed_quantity | Boolean value. Set fixed_quantity to false for Open Quantity. Default value is true. |

| payment_button | Payment button's text. Available options are buy and pay. Default value is pay. |

| reference_1_label | Label #1 to reconcile payments (Max of 20 characters). Default value is Reference 1. |

| reference_2_label | Label #2 to reconcile payments (Max of 20 characters). Default value is Reference 2. |

| email_link | A URL that email to customer after payment is successful. |

| tax | Tax rate in positive integer format. |

| photo | This image will be resized to retina (960x960) and avatar (180x180) dimensions. Whitelisted formats are jpg, jpeg, gif and png. |

| split_payments[][email] | The email address of the split rule's recipient (The account must be a verified account). |

| split_payments[][fixed_cut] | A positive integer in the smallest currency unit that is going in your account (e.g 100 cents to charge RM 1.00) This field is required if split_payment[variable_cut] is not present. |

| split_payments[][variable_cut] | Percentage in positive integer format that is going in your account. This field is required if split_payment[fixed_cut] is not present. |

| split_payments[][stack_order] | Integer format that defines the sequence of the split rule recipients. This field is required and must be in correct order starts from 0 and increment by 1 subsequently if you want to set a split rule. This input is crucial to determine a precise recipient's order. |

| split_header | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

| redirect_uri | URL to redirect the customer after payment (completed or failed). Billplz will do a GET to redirect_uri, with bill's ID appended to the URL (additional paid, paid_at and x_signature if x_signature is enabled). |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | The collection ID. |

| title | The collection's title. |

| description | The collection description. |

| reference_1_label | Label #1 to reconcile payments. |

| reference_2_label | Label #2 to reconcile payments. |

| email_link | A URL that email to customer after payment is successful. |

| amount | The collection's fixed amount to create bill in the smallest currency unit. |

| fixed_amount | Boolean value. It returns to false if Open Amount. |

| tax | Tax rate in positive integer format. |

| fixed_quantity | Boolean value. It returns false if Open Quantity. |

| payment_button | Payment button's text. |

| photo[retina_url] | The retina dimension's (960x960) URL. |

| photo[avatar_url] | The avatar dimension's (180x180) URL. |

| split_header | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

| split_payments | Array that contains all split rule recipients in hash format. email in hash represents the recipient's email. fixed_cut in hash represents the recipient's fixed cut in smallest and positive currency unit. variable_cut is the recipient's percentage cut in positive integer format. stack_order is the order of the recipient defined in split rules. |

| url | URL to the collection. |

| redirect_uri | URL to redirect the customer after payment (completed or failed). Billplz will do a GET to redirect_uri, with bill's ID appended to the URL (additional paid, paid_at and x_signature if x_signature is enabled). |

Get an Open Collection

Use this API to query your open collection record.

Example request:

# Get an open collection

curl https://www.billplz.com/api/v4/open_collections/0pp87t_6 \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante. Fusce ut neque justo, et aliquet enim. In hac habitasse platea dictumst.",

"reference_1_label": null,

"reference_2_label": null,

"email_link": null,

"amount": 299,

"fixed_amount": true,

"tax": null,

"fixed_quantity": true,

"payment_button": "pay",

"photo": {

"retina_url": null,

"avatar_url": null

},

"split_header": false,

"split_payments": [],

"url": "https://www.billplz.com/0pp87t_6",

"status": "active",

"redirect_uri": null

}

HTTP REQUEST

GET https://www.billplz.com/api/v4/open_collections/{COLLECTION_ID}

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | The collection ID. |

| title | The collection's title. |

| description | The collection description. |

| reference_1_label | Label #1 to reconcile payments. |

| reference_2_label | Label #2 to reconcile payments. |

| email_link | A URL that email to customer after payment is successful. |

| amount | The collection's fixed amount to create bill in the smallest currency unit. |

| fixed_amount | Boolean value. It returns to false if Open Amount. |

| tax | Tax rate in positive integer format. |

| fixed_quantity | Boolean value. It returns false if Open Quantity. |

| payment_button | Payment button's text. |

| photo[retina_url] | The retina dimension's (960x960) URL. |

| photo[avatar_url] | The avatar dimension's (180x180) URL. |

| split_header | Boolean value. All bill and receipt templates will show split rule recipient's infographic if this was set to true. |

| split_payments | Array that contains all split rule recipients in hash format. email in hash represents the recipient's email. fixed_cut in hash represents the recipient's fixed cut in smallest and positive currency unit. variable_cut is the recipient's percentage cut in positive integer format. stack_order is the order of the recipient defined in split rules. |

| url | URL to the collection. |

| status | Collection's status, it is either active and inactive. |

| redirect_uri | URL to redirect the customer after payment (completed or failed). Billplz will do a GET to redirect_uri, with bill's ID appended to the URL (additional paid, paid_at and x_signature if x_signature is enabled). |

Get Open Collection Index

Use this API to retrieve your open collections list. To utilise paging, append a page parameter to the URL e.g. ?page=1. If there are 15 records in the response you will need to check if there is any more data by fetching the next page e.g. ?page=2 and continuing this process until no more results are returned.

Example request:

# Get open collection index

curl https://www.billplz.com/api/v4/open_collections \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"open_collections": [

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante. Fusce ut neque justo, et aliquet enim. In hac habitasse platea dictumst.",

"reference_1_label": "ID No",

"reference_2_label": "First Name",

"email_link": "http://www.test.com",

"amount": null,

"fixed_amount": false,

"tax": 1,

"fixed_quantity": false,

"payment_button": "buy",

"photo": {

"retina_url": "https://sample.net/assets/uploadPhoto.png",

"avatar_url": "https://sample.net/assets/uploadPhoto.png"

},

"split_header": false,

"split_payments": [

{

"email": "[email protected]",

"fixed_cut": null,

"variable_cut": 20,

"stack_order": 0

}

],

"url": "https://www.billplz.com/0pp87t_6",

"status": "active",

"redirect_uri": null

}

],

"page": 1

}

Example request with optional arguments:

# Get collection index

curl https://www.billplz.com/api/v4/open_collections?page=2&status=active \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"open_collections": [

{

"id": "0pp87t_6",

"title": "MY FIRST API OPEN COLLECTION",

"description": "Maecenas eu placerat ante. Fusce ut neque justo, et aliquet enim. In hac habitasse platea dictumst.",

"reference_1_label": "ID No",

"reference_2_label": "First Name",

"email_link": "http://www.test.com",

"amount": null,

"fixed_amount": false,

"tax": 1,

"fixed_quantity": false,

"payment_button": "buy",

"photo": {

"retina_url": "https://sample.net/assets/uploadPhoto.png",

"avatar_url": "https://sample.net/assets/uploadPhoto.png"

},

"split_header": false,

"split_payments": [

{

"email": "[email protected]",

"fixed_cut": null,

"variable_cut": 20,

"stack_order": 0

}

],

"url": "https://www.billplz.com/0pp87t_6",

"status": "active",

"redirect_uri": null

}

],

"page": 2

}

HTTP REQUEST

GET https://www.billplz.com/api/v4/open_collections

OPTIONAL ARGUMENTS

| Parameter | Description |

|---|---|

| page | Up to 15 open collections will be returned in a single API call per specified page. Default to 1 if not present. |

| status | Parameter to filter open collection's status, valid value are active and inactive. |

Customer Receipt Delivery

By default, all collections follow the Global Customer Receipt Notification configuration in your Account settings.

You can override the Global configuration on individual collections by calling activate and deactivate.

Activate

If you wish to ignore the Global configuration and always send a receipt email to your customers, you may activate it per individual collection by calling to this API.

Example request:

# Activate a collection's customer receipt delivery

curl -X POST \

https://www.billplz.com/api/v4/collections/qag4fe_o6/customer_receipt_delivery/activate \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{}

HTTP REQUEST

POST https://www.billplz.com/api/v4/collections/{COLLECTION_ID}/customer_receipt_delivery/activate

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | Collection ID returned in Collection object. |

Deactivate

If you wish to ignore the Global configuration and always not to send a receipt email to your customers, you may deactivate it per individual collection by calling to this API.

Example request:

# Deactivate a collection's customer receipt delivery

curl -X POST \

https://www.billplz.com/api/v4/collections/qag4fe_o6/customer_receipt_delivery/deactivate \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{}

HTTP REQUEST

POST https://www.billplz.com/api/v4/collections/{COLLECTION_ID}/customer_receipt_delivery/deactivate

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | Collection ID returned in Collection object. |

Set Global

Use this API to set your individual collections to follow Global Customer Receipt Notification configuration if you want your collection to send the email base on Global configuration. By default, all collections are following Global configuration.

Example request:

# Set a collection's customer receipt delivery to Global

curl -X POST \

https://www.billplz.com/api/v4/collections/qag4fe_o6/customer_receipt_delivery/global \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{}

HTTP REQUEST

POST https://www.billplz.com/api/v4/collections/{COLLECTION_ID}/customer_receipt_delivery/global

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | Collection ID returned in Collection object. |

Get Status

Use this API to get a Collection's Customer Receipt Notification status.

Example request:

# Get a collection's customer receipt delivery

curl https://www.billplz.com/api/v4/collections/qag4fe_o6/customer_receipt_delivery \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"id": "qag4fe_o6",

"customer_receipt_delivery": "global"

}

HTTP REQUEST

GET https://www.billplz.com/api/v4/collections/{COLLECTION_ID}/customer_receipt_delivery

URL PARAMETER

| Parameter | Description |

|---|---|

| COLLECTION_ID | Collection ID returned in Collection object. |

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| id | ID that represents a collection. |

| customer_receipt_delivery | Collection's Customer Receipt Notification status, it is either active, inactive or global. |

Webhook Rank

Webhook Rank has been introduced to ensure callback is running at it's best. The higher the ranking, the higher priority for the callback to be executed. Use this API to query your current Account Ranking. 0.0 indicate highest ranking (default) and 10.0 lowest ranking.

Example request:

# Webhook Rank

curl https://www.billplz.com/api/v4/webhook_rank \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"rank": 0.0

}

HTTP REQUEST

GET https://www.billplz.com/api/v4/webhook_rank

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| rank | Ranking Number (0.0 - 10.0) |

Get Payment Gateways

Use this API to get a complete list of supported payment gateways' bank code that need for setting reference_1 in API#bypass-billplz-bill-page.

This API returns not only online banking, but also all other payment gateways' bank code that are supported in API#bypass-billplz-bill-page.

Example request:

curl https://www.billplz.com/api/v4/payment_gateways \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81:

Response:

{

"payment_gateways": [

{

"code": "MBU0227",

"active": true,

"category": "fpx"

},

{

"code": "OCBC0229",

"active": false,

"category": "fpx"

},

{

"code": "BP-FKR01",

"active": true,

"category": "billplz"

},

{

"code": "BP-PPL01",

"active": true,

"category": "paypal"

},

{

"code": "BP-2C2P1",

"active": false,

"category": "2c2p"

},

{

"code": "BP-OCBC1",

"active": true,

"category": "ocbc"

}

]

}

HTTP REQUEST

GET https://www.billplz.com/api/v4/payment_gateways

RESPONSE PARAMETER

| Parameter | Description |

|---|---|

| code | This is the bank code that need to set to reference_1. Case sensitive. |

| active | true or false boolean that represents payment gateway's availability. If an inactive / invalid payment gateway was set to reference_1, the payment process will show Billplz page for payer to choose another payment option from the list. |

| category | Category this payment gateway belongs to. |

Payment Gateway Abbreviations

| Code | Name |

|---|---|

| ABMB0212 | allianceonline |

| ABB0233 | affinOnline |

| ABB0234* | Affin Bank |

| AMBB0209 | AmOnline |

| AGRO01 | AGRONet |

| BCBB0235 | CIMB Clicks |

| BIMB0340 | Bank Islam Internet Banking |

| BKRM0602 | i-Rakyat |

| BMMB0341 | i-Muamalat |

| BOCM01* | Bank of China |

| BSN0601 | myBSN |

| CIT0219 | Citibank Online |

| HLB0224 | HLB Connect |

| HSBC0223 | HSBC Online Banking |

| KFH0346 | KFH Online |

| MB2U0227 | Maybank2u |

| MBB0228 | Maybank2E |

| OCBC0229 | OCBC Online Banking |

| PBB0233 | PBe |

| RHB0218 | RHB Now |

| SCB0216 | SC Online Banking |

| UOB0226 | UOB Internet Banking |

| UOB0229* | UOB Bank |

| TEST0001* | Test 0001 |

| TEST0002* | Test 0002 |

| TEST0003* | Test 0003 |

| TEST0004* | Test 0004 |

| TEST0021* | Test 0021 |

| TEST0022* | Test 0022 |

| TEST0023* | Test 0023 |

| BP-FKR01* | Billplz Simulator |

| BP-BILLPLZ1 | Visa / Mastercard (Billplz) |

| BP-PPL01 | PayPal |

| BP-OCBC1 | Visa / Mastercard |

| BP-2C2P1 | e-pay |

| BP-2C2PC | Visa / Mastercard |

| BP-2C2PU | UnionPay |

| BP-2C2PGRB | Grab |

| BP-2C2PGRBPL | GrabPayLater |

| BP-2C2PATOME | Atome |

| BP-2C2PBST | Boost |

| BP-2C2PTNG | TnG |

| BP-2C2PSHPE | Shopee Pay |

| BP-2C2PSHPQR | Shopee Pay QR |

| BP-2C2PIPP | IPP |

| BP-BST01 | Boost |

| BP-TNG01 | TouchNGo E-Wallet |

| BP-SGP01 | Senangpay |

| BP-BILM1 | Visa / Mastercard |

| BP-RZRGRB | Grab |

| BP-RZRBST | Boost |

| BP-RZRTNG | TnG |

| BP-RZRPAY | RazerPay |

| BP-RZRMB2QR | Maybank QR |

| BP-RZRWCTP | WeChat Pay |

| BP-RZRSHPE | Shopee Pay |

| BP-MPGS1 | MPGS |

| BP-CYBS1 | Secure Acceptance |

| BP-EBPG1 | Visa / Mastercard |

| BP-EBPG2 | AMEX |

| BP-PAYDE | Paydee |

| BP-MGATE1 | Visa / Mastercard / AMEX |

| B2B1-ABB0235 | AFFINMAX |

| B2B1-ABMB0213 | Alliance BizSmart |

| B2B1-AGRO02 | AGRONetBIZ |

| B2B1-AMBB0208 | AmAccess Biz |

| B2B1-BCBB0235 | BizChannel@CIMB |

| B2B1-BIMB0340 | Bank Islam eBanker |

| B2B1-BKRM0602 | i-bizRAKYAT |

| B2B1-BMMB0342 | iBiz Muamalat |

| B2B1-BNP003 | BNP Paribas |

| B2B1-CIT0218 | CitiDirect BE |

| B2B1-DBB0199 | Deutsche Bank Autobahn |

| B2B1-HLB0224 | HLB ConnectFirst |

| B2B1-HSBC0223 | HSBCnet |

| B2B1-KFH0346 | KFH Online |

| B2B1-MBB0228 | Maybank2E |

| B2B1-OCBC0229 | Velocity@ocbc |

| B2B1-PBB0233 | PBe |

| B2B1-PBB0234 | PB enterprise |

| B2B1-RHB0218 | RHB Reflex |

| B2B1-SCB0215 | SC Straight2Bank |

| B2B1-TEST0021* | SBI Bank A |

| B2B1-TEST0022* | SBI Bank B |

| B2B1-TEST0023* | SBI Bank C |

| B2B1-UOB0228 | UOB BIBPlus |

* Only applicable in staging environment.

Tokenization

This feature allows you to exchange for a card's tokenization from our provider's PCI DSS certified vault, and use the token to charge your customer later.

Providers

| Provider | Type | Eligibility |

|---|---|---|

| Senangpay | 3DS | Any paid membership plan |

Senangpay

This feature enables you to tokenize 3DS Visa / Mastercard cards to be charged later, which will be stored in Senangpay's PCI DSS certified servers.

Ways to use Senangpay's tokenization:

- Tokenize customer's card, so they only need to enter their card details once.

- Using token obtained, pay a Billplz bill by charging customers's card, anytime, any amount.

- Using token obtained, pre authorize a bill payment, and capture later in the future.

Create Card

Use this API to create a card token for 3DS Visa / Mastercard cards. Remember to store the response, as no card details nor tokens will be stored in Billplz's servers.

Flow

- Create card & token using this Create Card API.

- Merchant redirects card holder to Senangpay's 3DS authentication page.

- Card holder inputs credit/debit card details and submits the form.

- Upon 3DS verifcation success, Billplz will send a POST request to merchant's callback_url containing masked card details together with CARD_ID and TOKEN.

- Merchant compares the checksum sent, and store card details if they match.

To charge a card with the token generated, refer to Charge Card API.

Example request:

# Creates a card token

curl https://www.billplz.com/api/v4/cards \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-d name="Michael" \

-d email="[email protected]" \

-d phone="60122345678" \

-d callback_url="https://example.com/callback_url"

Response:

{

"id": "8727fc3a-c04c-4c2b-9b67-947b5cfc2fb6",

"card_number": null,

"provider": null,

"token": null,

"status": "pending",

"authentication_redirect_url": "https://senangpay.my/some_link",

"callback_url": "https://example.com/callback_url"

}

HTTP REQUEST

POST https://www.billplz.com/api/v4/cards

REQUIRED ARGUMENTS

| Parameter | Description |

|---|---|

| name | Name on the card / name of the card owner. |

| Email of the card owner. | |

| phone | Contact number of card owner. |

| callback_url | Web hook URL to be called after card token is created. It will POST a Card object. |

Delete Card

Use this API to delete a card.

Example request:

# Delete an active card token

curl -X DELETE https://www.billplz.com/api/v4/cards/8727fc3a-c04c-4c2b-9b67-947b5cfc2fb6 \

-u 73eb57f0-7d4e-42b9-a544-aeac6e4b0f81: \

-d token="77d62ad5a3ae56aafc8e3529b89d0268afa205303f6017afbd9826afb8394740"

Response:

{

"id": "8727fc3a-c04c-4c2b-9b67-947b5cfc2fb6",

"card_number": "1118",

"provider": "mastercard",

"token": "77d62ad5a3ae56aafc8e3529b89d0268afa205303f6017afbd9826afb8394740",

"status": "deleted"

}

HTTP REQUEST

DELETE https://www.billplz.com/api/v4/cards/{CARD_ID}

REQUIRED ARGUMENTS

| Parameter | Description |

|---|---|

| token | Card's token. |

3D Secure Update

Billplz will send a POST request to callback_url provided within an hour, regardless the card holder has completed the 3DSecure verification or not. This callback_url will also serve as redirect_url on the client's side. You are required to redirect every time the 3D secure update is being given regardless of callback or redirect.

Example request to callback_url:

# POST request sent by Billplz to your callback_url

curl https://www.example.com/callback \

-d id="a35296ad-b50c-4179-8024-036da00c1aee" \

-d card_number="1118" \

-d provider="mastercard" \

-d token="77d62ad5a3ae56aafc8e3529b89d0268afa205303f6017afbd9826afb8394740" \

-d status="active" \

-d checksum="ef5e54a22af0925cba88fab467119742e90262e3646eea1dee3949938daf3a38"

HTTP REQUEST

POST {CALLBACK_URL}

POST PARAMETER

| Parameter | Description |

|---|---|

| id | ID that represents card. |

| card_number | Last 4 digits of card's number. |

| token | Card's token. |

| status | Status that represents the card's status, possible values are pending, active, failed, and deleted. |

| checksum | Digital signature computed with posted data and shared XSignature Key. |

CHECKSUM

Checksum is a digital signature computed with posted data and shared XSignature Key, similar to the X Signature received on Payment Completion.

For security purposes, checksum is inserted into this POST request so that merchants can verify this request comes from Billplz. To learn more on how to calculate this checksum, click here.

Charge Card

Use this API to make bill payment by charging a Visa / Mastercard card with token generated.

REQUIREMENTS

- Collection without split recipients (split payment).

- Bill. Email and Mobile number are required during bill creation.

- Card Token & ID.

Example request:

# Make bill payment with token